Do I apply to retire through MPERS or my employer?

Your Notice of Retirement form must ultimately be submitted to MPERS. You can complete the Notice of Retirement form electronically via your myMPERS Secure Member Access account or you can contact MPERS or your employer to obtain a paper form.

When will MPERS notify my employer that I have applied to retire?

MPERS will notify your employer the first of the month following receipt of the Notice of Retirement form. For example, if you submit your Notice of Retirement form on January 15th, MPERS will notify your employer on February 1st.

Must MPERS notify my employer of my retirement?

We notify the employers of all new retirements so that they may process the retiree’s medical insurance premiums appropriately.

In what format can I return the forms and proof documents associated with the retirement process to MPERS?

MPERS does not require any original documentation. Documentation can be scanned and emailed to mpers@mpers.org or faxed to MPERS at 573-522-6111. You can also mail documents to MPERS, PO Box 1930, Jefferson City, MO 65102-1930. Please do not include full social security numbers on any documentation that is emailed to MPERS.

Can I postpone my retirement after I have applied to retire?

If you applied to retire on a particular date and desire to postpone your retirement to a later date, you may do so by sending MPERS a written request of your desire to postpone. An email to mpers@mpers.org will suffice as a written request. Keep in mind that you must apply to retire no later than one month in advance of your retirement date and no sooner than four months in advance of your retirement date. For example, a Notice of Retirement form signed and submitted in January for a retirement date of March 1st can be postponed to April or May. If a postponement to June or beyond is required, you must cancel your Notice of Retirement form and reapply at a later date.

Can I cancel my retirement after I have applied to retire?

If you applied to retire and no longer wish to retire, you may cancel your retirement by sending MPERS a written request of your desire to cancel. An email to mpers@mpers.org will suffice as a written request. IMPORTANT: once MPERS sends you your first benefit payment, you can no longer cancel your retirement.

When will I receive my retirement benefits?

MPERS pays benefits once per month; always on the last working day of each month. For example, the March 2018 benefit would be paid on March 30th as March 31st is a Saturday.

What happens if I miss a deadline in the two-step retirement application process?

If you miss the filing deadline for step 1, the Notice of Retirement form, then your retirement will be delayed by at least one month (depending on when your Notice of Retirement form is ultimately received by MPERS).

If you miss the filing deadline for step 2, the Retirement Election form, then payment of your first benefit will be delayed by at least one month (depending on when your Retirement Election form is ultimately received by MPERS). For example, if you are retiring January 1st, but did not submit your Retirement Election form by the December 31st deadline, then you will not receive your first retirement benefit on January 31st as expected. Instead, you will receive two retirement benefits (one for January and one for February) on February 28th (provided that you timely submit your Retirement Election form). Applications to retire become null and void if the Retirement Election form is not submitted within 90 days of the date of retirement listed on your Notice of Retirement form.

Can I name someone other than a spouse as a beneficiary for my retirement?

Only the spouse of a member can be named as a beneficiary for the joint and 50% survivor or joint and 100% survivor benefit payment options.

Anyone can be named as a beneficiary for one of the guaranteed payment options (e.g., spouse, child, parent, friend, charity, etc.)

Can you explain the guaranteed payment options?

The guaranteed payment options are a source of confusion for our members. A guaranteed payment option reduces your benefit for the rest of your life. You, the retiree, will receive the reduced benefit for the rest of your life—no matter how long you live. However, the guaranteed payment window (i.e., 60, 120, or 180 months) starts at the time you retire—not at the time of your death. For example, someone who chooses 120 guaranteed payments but lives for only 60 months, will have 60 more benefit payments to pass on to a designated beneficiary(ies). Someone who chooses 120 guaranteed payments that lives for more than 120 months will have no more benefit payments to pass on to a designated beneficiary(ies). For clarity, a retiree who outlives the guaranteed payment window will not stop receiving the benefit unless the retiree dies. Guaranteed payment option beneficiaries can be changed at any time.

Does my spouse have to sign the Retirement Election form?

If you are married and choose either the life income annuity or one of the guaranteed payment options, then your spouse must consent to your election by signing the Retirement Election form. If you are married and choose either the joint and 50% survivor or the joint and 100% survivor, then your spouse does not need to consent to your election and does not need to sign the form.

I am married but I am choosing the life income annuity payment option. Am I still required to provide you with my spouse’s proof-of-age document and my marriage certificate?

If you are married and choose either the life income annuity or one of the guaranteed payment options, then you do not need to submit your spouse’s proof-of-age document or your marriage certificate.

Do I need to complete the “Beneficiary Designation for Final Payment and Remaining Guaranteed Payments” section of the Retirement Election form?

The benefit payment that you are scheduled to receive at the end of the month in which you pass away remains payable and does not need to be returned to the system. MPERS will direct deposit this final payment to your bank account as normal. However, if your bank were to reject this final deposit due to your passing, MPERS will pay your final benefit to the designated beneficiary on your Retirement Election form.

If you are married and elect either the joint and 50% survivor or joint and 100% survivor benefit payment options, then you do not need to designate a beneficiary for your final payment—your spouse will automatically receive your final payment as well as the subsequent lifetime survivor benefits.

If you elect one of the guaranteed payment benefit payment options, then the designated beneficiary on your Retirement Election form will receive your final payment as well as any remaining guaranteed payments (if the guaranteed payment window has not already expired).

Can I change the benefit payment option that I chose on the Retirement Election Form?

Once MPERS has sent you your first retirement benefit payment, you can no longer change your benefit payment option except under two specific circumstances:

- If you were single at the time of retirement and chose the life income annuity option and later get married, you will have one year from your date of marriage to name your spouse as a beneficiary for either the joint and 50% survivor or joint and 100% survivor options.

- If you were married at retirement and chose either the joint and 50% survivor or joint and 100% survivor options and your spouse dies before you and you later remarry, you will have one year from your date of marriage to name your new spouse as a beneficiary for either the joint and 50% survivor or joint and 100% survivor options.

What happens to my unused sick leave when I retire?

You will receive one month of creditable service towards the calculation of your retirement benefit for every 168 hours of unused sick leave. Credit for unused sick leave is granted in whole month increments only. For example, if your final unused sick leave balance is 200 hours, the remaining 32 hours will not count towards the calculation of your retirement benefit. Credit for unused sick leave does not change your eligibility to retire, i.e., it cannot allow you to retire sooner but it will increase your retirement benefit by providing you with more service credit.

What happens to my annual leave and compensatory time (comp time) when I retire?

Your annual leave and compensatory time balances do not factor into your MPERS retirement benefit. You must contact your employer to discuss your options for annual leave and comp time balances.

I am interested in acquiring credit for prior public service. Can I acquire that time after I have applied to retire?

All outside service credit must be acquired before you apply to retire. As a reminder, you must apply to retire no later than one month in advance of your desired retirement date.

Can I have my retirement benefit deposited in the same account as my paycheck?

Yes, however, MPERS does not share payroll information with your employer. You will complete a Direct Deposit Authorization form as part of the two-step retirement process through MPERS.

I want to retire/live in a country other than the United States. Can I have my retirement benefit direct deposited in a different country?

Yes, but you will need to open an account with a local branch of a U.S. chartered bank. Many large banks have local branches in foreign countries. Please call us to discuss your individual situation.

Can I change my direct deposit at any time?

Yes, you may change your direct deposit electronically via your myMPERS Secure Member Access account or by contacting MPERS for a paper form.

Will I receive a paystub each month?

You can access your monthly pay stubs electronically via your myMPERS Secure Member Access account.

Someone told me that I will not have to pay Missouri state income tax on my retirement benefit. Is that true?

Your retirement benefit through MPERS is subject to federal and state income taxes. However, the state of Missouri does have a public pension exemption. Your benefit through MPERS qualifies as a “public pension.” Here is a link to the Missouri Department of Revenue’s explanation of the public pension exemption (scroll down to “How is my public pension taxed?”): http://dor.mo.gov/faq/personal/indiv.php.

Representatives of MPERS are not authorized to dispense tax advice. We recommend that you contact a tax professional if you have questions about your tax situation.

Can I change my tax withholdings at any time?

Yes, you change your tax withholdings electronically via your myMPERS Secure Member Access account or by contacting MPERS for a paper form.

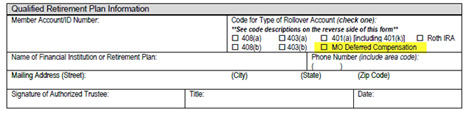

How do I roll over my BackDROP distribution to the Missouri Deferred Compensation Plan?

In order to defer taxation, you can roll over your BackDROP to an IRA or eligible employer-sponsored retirement plan, including the Missouri Deferred Compensation Plan. Please note that rollovers to Roth IRAs are taxed in the year in which they are rolled over. If electing to roll over your BackDROP, the BackDROP Distribution form requires that your financial institution complete the “Agreement of Bank, Financial Institution or Retirement Plan” section of the form. However, since MPERS works closely with Missouri Deferred Compensation, if you are rolling over your BackDROP to the Missouri Deferred Compensation Plan, you can check the “MO Deferred Compensation” box under the agreement section (see picture below) and send the form directly to MPERS. MPERS will then send the form to Missouri Deferred Compensation Plan on your behalf for completion of the agreement section.

Will I owe taxes on my BackDROP distribution?

If you elect to receive your BackDROP in cash (or partly in cash), then the amount that you receive in cash is reported as taxable income in the year in which you receive it. MPERS is required to withhold 20 percent for federal tax from BackDROP distributions taken as cash. MPERS does not withhold for state tax, although you may owe state tax on BackDROP distributions taken as cash. Additionally, if you elect to receive your BackDROP in cash, an early distribution penalty of 10 percent may be assessed by the IRS if you are under age 59½ unless an exception applies. A notable exception as it pertains to MPERS is that if you separate service in the year in which you turn 55 or later, then you are exempt from the 10 percent early distribution penalty. Qualified public safety officers are exempt from the early distribution penalty on BackDROP distributions taken as cash so long as they separate from service in the year in which they turn 50 or later.

BackDROP payments that are rolled over into qualified retirement accounts are not subject to the 20 percent withholding requirement and also not subject to the 10 percent early distribution penalty.

Who can I name as my “agent” on the Designation of Agent form and what exactly is the purpose of this form?

The Designation of Agent form is optional but recommended. You can name anyone (such as a spouse, child, relative, friend, etc.) to be your agent. Because your agent will have the authority to act on your behalf with regards to your MPERS-related affairs in the event that you become disabled or incapacitated, you should choose someone whom you fully trust to act in your best interest. The agent’s powers to act on your behalf will only take effect upon written notification from your physician regarding your disablement or incapacity. You can revoke your designation of an agent at any time.

When will I receive my annual Cost-of-Living Adjustment (COLA)?

Closed Plan retirees receive their annual COLA every October.

Year 2000 Plan retirees receive their COLA on the anniversary of their retirement date, or if BackDROP is elected, on the anniversary of their BackDROP date.

2011 Tier retirees receive their COLA on the anniversary of their retirement date.

Benefit payments are made on the last working day of each month, therefore, for example, a Closed Plan retiree receiving the COLA in October can expect to see the increase reflected in the October 31st benefit payment (assuming October 31st did not fall on a weekend).